Friend, I like to share financials to encourage others. It benefits everyone when we talk about these things at the small expense of bruising an ego or three. ✌️

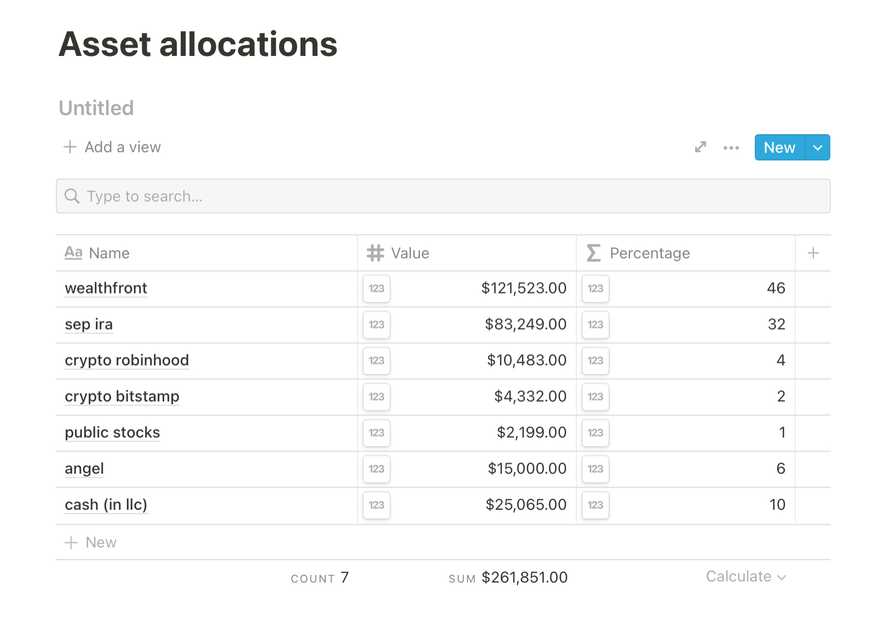

Here's my asset allocation after 6 years in Silicon Valley. I came here with about $4000 to my name after a few shorter stints digital nomad style. The landing was rough – lived on a mattress in the living room for the first two weeks.

Going from broke to not-broke happens in 2 steps:

- Increase your cashflow

- Pay yourself first

The famous fuck you money advice from Lucy Liu.

Increase your cashflow

This part is easy: You're an engineer.

Software engineers are one of the most sought-after people in the world. It's the 2nd best job in USA in terms of prospects and ease of starting.

There were 207,000 job openings for software engineers in December 2020. The market is hot hot hot.

Here's advice I shared on why you aren't drowning in recruiters too and how to approach job hunting like an asset, not a beggar.

Pay yourself first

Ok you've got money coming in, now what?

The traditional advice is to "save", but that sounds lame. If you skip the avocado toast you'll have $6000 in ten years.

I enjoy avocado toast and $6 matcha lattes. What's the point of life, if you can't enjoy it?

You should invest. Turn your cashflow into wealth.

Pay yourself first is an idea from The Richest Man in Babylon and it finally clicked for me after reading Profit First.

Profit is not what's left after expenses, expenses are what's left after profit.

You pay yourself first, then fit your life into what's left. 🤨

Here's how that shakes out:

My average income in 2021 has been $18,380/mo. Most of it from the dayjob. The infoproducts business, which this newsletter is part of, has turned into more of an expensive hobby lately.

Despite the $18,380 that comes in, my lifestyle fits into $5,200/mo. That covers everything I value.

$18,380/mo -$3,670 for taxes -$600 for index funds -$200 for cash buffer -$920 for profit -$940 for retirement

That leaves $12,000 for life and business. $5,200 goes for life in San Francisco. Rent, food, leisure, ... adds up fast not gonna lie 😅

The rest – about $6,800 – is for high risk hopefully high reward bets. A large part goes into running the infoproducts side business.

About $2,700 in monthly fixed costs right now. Making a loss and hoping for big things soon.

Like I said, it's an expensive hobby right now 😇

The other $4000-ish ebbs and flows. Sometimes I invest in myself and the business with expensive coaching, other times I dump it into RobinHood and play stocks.

One time I made an angel investment and I wanna make more. They're fun!

The barbel strategy

The core of my approach is the barbel strategy that Nassim Taleb talks about in his books.

Cap your downside, maximize your upside.

Never invest more than you can afford to lose. That's why I focused on stability first. Creating a safety net.

I like to share financials to encourage others. Here’s my asset allocation after 6 years in Silicon Valley.

— Swizec Teller (@Swizec) July 30, 2021

Came here with about $4000 to my name and focused on feeling secure first. “The immigrant work ethic” my girlfriend calls it.

Now I’m learning how to make bigger bets ✌️ pic.twitter.com/nNstELy4rx

As long as I invest profits, not debt, the worst that could happen is that everything blows up and I go back home to Slovenia where my savings last 5 to 6 years with no income.

Even a tech dayjob has the barbel strategy built in!

Cushy salary caps your downside. Equity lets you partake in the upside.

When you think about it, engineers are paid like athletes or movie stars. You get a 4 year agreement with a company. They pay you salary (caps downside) and give you equity that vests over 4 years (large potential upside).

As a senior software engineer, my cash comp over 4 years comes out to about $700,000 right now. I'm not gonna starve.

The equity? Oh that could be anywhere between $0 and $4,000,000, but never negative. We'll see 🤷♂️

Yes, working at a FAANG has higher expected return. Do you want the predictability of a Toyota Corolla or the excitement of a Lamborghini?

Once you've capped your downside, go for the big swing my friend. You deserve it.

Cheers,

~Swizec

PS: this is not financial advice and I am not a professional, do your own math before making moves

Continue reading about Pay yourself first

Semantically similar articles hand-picked by GPT-4

- Why you should talk about engineering salaries

- What I learned while 6x-ing my income in 4 years

- How to make what you're worth even if you're from the wrong country

- How I stopped chasing mice in 2021

- "If you're so good, why aren't you making 600k at BigTech?"

Learned something new?

Read more Software Engineering Lessons from Production

I write articles with real insight into the career and skills of a modern software engineer. "Raw and honest from the heart!" as one reader described them. Fueled by lessons learned over 20 years of building production code for side-projects, small businesses, and hyper growth startups. Both successful and not.

Subscribe below 👇

Software Engineering Lessons from Production

Join Swizec's Newsletter and get insightful emails 💌 on mindsets, tactics, and technical skills for your career. Real lessons from building production software. No bullshit.

"Man, love your simple writing! Yours is the only newsletter I open and only blog that I give a fuck to read & scroll till the end. And wow always take away lessons with me. Inspiring! And very relatable. 👌"

Have a burning question that you think I can answer? Hit me up on twitter and I'll do my best.

Who am I and who do I help? I'm Swizec Teller and I turn coders into engineers with "Raw and honest from the heart!" writing. No bullshit. Real insights into the career and skills of a modern software engineer.

Want to become a true senior engineer? Take ownership, have autonomy, and be a force multiplier on your team. The Senior Engineer Mindset ebook can help 👉 swizec.com/senior-mindset. These are the shifts in mindset that unlocked my career.

Curious about Serverless and the modern backend? Check out Serverless Handbook, for frontend engineers 👉 ServerlessHandbook.dev

Want to Stop copy pasting D3 examples and create data visualizations of your own? Learn how to build scalable dataviz React components your whole team can understand with React for Data Visualization

Want to get my best emails on JavaScript, React, Serverless, Fullstack Web, or Indie Hacking? Check out swizec.com/collections

Did someone amazing share this letter with you? Wonderful! You can sign up for my weekly letters for software engineers on their path to greatness, here: swizec.com/blog

Want to brush up on your modern JavaScript syntax? Check out my interactive cheatsheet: es6cheatsheet.com

By the way, just in case no one has told you it yet today: I love and appreciate you for who you are ❤️